Important: We updated this article in July 2025 after fact checking against Social Security Administration (SSA) policy data. If you’re thinking about trying to retire early for health reasons, then you may qualify for disability in Connecticut. Right now, there are four different payment options available for Connecticut residents. The Social Security Administration manages two federal programs, and the state provides some limited disability assistance as well. Surprisingly, in 2024, just 3.5% of people in the Constitution State got Social Security disability payments.

We created this complete guide to help disabled CT residents get the payments they need to make ends meet. Learn how to apply, qualify, average pay amounts, how to boost your approval odds and more helpful info below.

How to Get Disability in Connecticut: Key Takeaways

- There are several types of disability benefits available from different federal and state programs for Connecticut residents. Each one has different requirements to qualify depending on your military service, income, work history, and other factors.

- If your disability stems from a work-related accident, learn how to get Connecticut worker’s compensation benefits first.

- You must prove to the SSA with medical evidence that you cannot work for at least a year to qualify for disability benefits. It doesn’t matter which of the two programs you apply for; this an absolute requirement. More specifically, you must prove you’re unable to work for medical reasons.

- The SSA awarded Social Security disability benefits to less than 1 in 5 first-time applicants (19%) in recent years. To significantly boost your chances for success, work with a disability lawyer to file your application.

- There are no short-term or temporary benefits available from the federal government. But if you apply for SSDI or SSI benefits, you may get temporary disability from the state’s SAGA program.

How Many Different Disability Services and Programs Offer Monthly Payments in CT?

Four different programs currently provide monthly disability in Connecticut to eligible applicants. However, you cannot receive money from all four at the same time. Importantly, both state-run programs only approve claims from people who first applied for federal benefits.

Most people should apply for Connecticut disability benefits in the following order:

- Social Security Disability Insurance (SSDI)

- Supplemental Security Income (SSI)

- Connecticut State-Administered General Assistance (SAGA)

- Connecticut’s SSI State Supplement (SSP)

Federal Program #1: Social Security Disability Insurance (SSDI) Benefits

This program helps insured workers access their maximum Social Security benefit before reaching full retirement age (67). However, since it does have a work history requirement, disabled children cannot qualify for SSDI benefits.

Social Security Disability Insurance Eligibility Requirements

First, the SSA will check your technical eligibility for SSDI by confirming all the following apply to you:

- At least 40 Social Security work credits. You can earn a maximum of 4 work credits per calendar year. As long as you pay Social Security payroll taxes, you’ll get one for every $1,810 you receive in work income.

- Younger than 67 and not currently drawing any other Social Security benefits. You can only draw one payment based on the work record associated with your Social Security Number (SSN). So, if you get early retirement or regular Social Security, you won’t qualify for SSDI.

- Not still working, and if you are, you must earn less than $1,620 per month. The SSA confirms this through a review of your most recent IRS and state tax records. If you’re blind, the monthly SSDI income limit increases to $2,700 per month before you make too much money to qualify.

- Not currently housed in an institutional facility or prison. People currently incarcerated in jail or prison cannot qualify for SSDI. This also applies to people living in nursing homes, long-term care or mental health facilities.

Once the SSA office confirms you meet all these requirements, they’ll forward your application to Disability Determination Services (DDS). The Connecticut DDS office will then review your medical history and schedule a consultative exam. Medical eligibility to receive SSDI means you must:

- Have a serious medical condition that’s expected to last a year or longer or result in your death.

- Be unable to work at all for at least 12 months, including in sedentary jobs, for medical reasons.

If DDS confirms your medical eligibility, then they’ll recommend the SSA award you SSDI disability in Connecticut.

Understanding Average Wait Times for SSDI Benefits

Six months from your SSDI application date is the soonest you’ll get your first payment from that federal program. The SSA says that it takes them 3-5 months to review each claim, on average. This period usually covers the mandatory five-month waiting period before the SSA can pay you benefits.

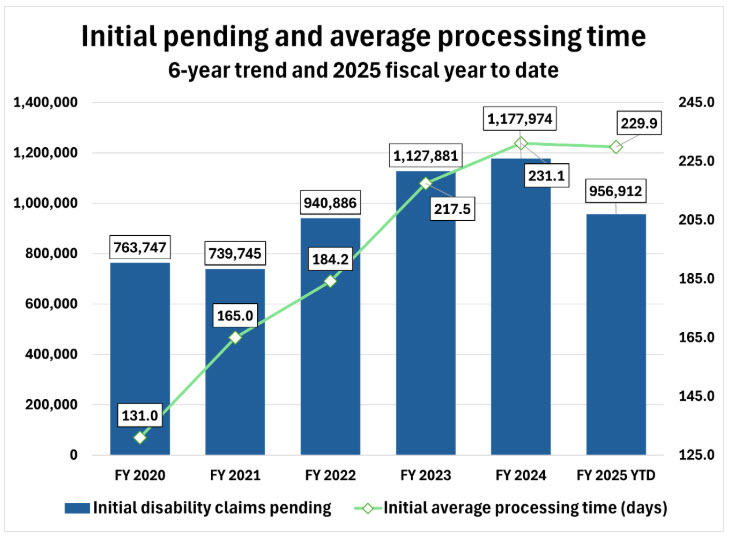

The SSA chart below for FY2025 shows how long it takes the agency to process claims for disability benefits nationwide, on average:

Average and Maximum SSDI Benefit Payments for 2025

By law, the most anyone can get in SSDI benefits per month at this time is $4,018. However, the average SSDI payment nationwide at this time is $1,580.

If you apply for SSDI benefits in CT right now, expect to get monthly payments that are somewhere between those dollar amounts. The SSA calculates your monthly benefit amount based solely on your past monthly job income. Your symptoms, diagnosis, or average monthly expenses have zero impact on how much SSDI money you can receive.

However, you may receive an annual raise in years when Congress approves a cost-of-living-adjustment (COLA) increase.

SSDI Approval Provides Medicare Access After 24 Months

On the two-year anniversary of your first SSDI benefits payment, you’re automatically enrolled in Medicare coverage. You do not need to be 65 years old in order to access these federal health insurance benefits.

Federal Program #2: Supplemental Security Income (SSI) Benefits

The federal SSI program pays benefits to blind and disabled children and adults, plus retirees aged 65+. There is no work history requirement, but program does have very strict income and asset limitations for those who qualify. Below are some key SSI eligibility requirements, maximum pay amounts, and other benefits that come with approval.

You Must Be Blind, Disabled, or Aged 65+ to Get SSI Disability in Connecticut

If you’re 65 or older when you apply for SSI benefits, the SSA only looks at your financial status to determine eligibility. The same applies if you were born blind.

In all other cases, children and adults younger than 65 must pass a medical eligibility exam. This is to determine whether you meet the Social Security Administration’s definition of disabled. It’s the same exam they use for SSDI applicants, and Disability Determination Services will schedule it for you. If you fail to appear for that exam, the SSA will automatically deny your SSI claim.

The Income and Asset Limits to Qualify for SSI Disability Benefits Are Very Low

Your total monthly household income must fall below $2,019 per month to qualify for SSI. That includes not just how much money you earn each month, but also your spouse, roommate, etc. The SSA adds all that income together when looking at your financial history.

If you’re applying as a single person who lives alone, you cannot own more than $2,000 in total assets. For married couples, the asset limit goes up to $3,000 before you own too many things you can sell for cash to get SSI.

Luckily, the SSI program always ignores certain resources you might own, including:

- Your home and the lot it’s on, if you own both

- One vehicle for daily transportation

- Wedding ring, furniture, clothing, appliances, bedding, towels, etc.

Individuals Can Receive No More Than $967 in Monthly SSI; for Couples, It’s $1,450

While these pay amounts seem quite small, SSI approval also opens the door to other state and federal benefits.

SSI Claim Approval Can Also Help You Get Medicaid Health Insurance in CT

Connecticut is one of the few states that make people on SSI file a separate application for Medicaid health insurance. Learn eligibility rules for CT’s Medicaid program, HUSKY, and apply online here.

If Your SSI Claim’s Approved, You’ll Also Qualify for Extra Disability in Connecticut Through Its State Supplement Program

Connecticut does pay additional benefits on top of your SSI monthly payment if you meet that state-run program’s rules. However, this extra money is not available to people that currently receive SAGA or SSDI payments. Here’s how much income you may get from Connecticut’s state supplement program:

- $178 per person, or $290 per couple for SSI beneficiaries living independently

- $41 per person, or $83 per couple for people on SSI living in Medicaid program-funded facilities

This money is in addition to your Connecticut disability benefits from the federal SSI program each month. To apply for Connecticut SSP or SAGA cash payments, health care and other benefits, start your application online now.

How the State-Administered General Assistance (SAGA) Program Awards Disability in Connecticut

You must first apply for SSDI and/or SSI benefits to qualify for Connecticut’s SAGA cash assistance program. SAGA’s designed to help you make ends meet while waiting for the SSA review your federal disability claim. To receive SAGA payments before your 65th birthday, you must be unable to work for:

- 2-6 months

- 6 months or longer, and unable to take part in any education or training programs

All SAGA applicants must also pass an income test to qualify for temporary Connecticut disability benefits. To qualify for SAGA, each person aged 22 and up must have:

- No more than $500 in assets per person, or $1,000 for a family of 4 or more people (i.e., bank balance, jewelry, or vehicle’s value beyond the $4,500 standard deduction amount)

- Less than $2,250 in monthly income from all sources combined

If SAGA approves your application, cash benefits are as follows:

- $219 per month for individuals with no income who pay rent/housing costs

- $55 per month for individuals with no income or housing costs (i.e., living in a shelter)

Once either the SSDI or SSI program approves your claim for Connecticut disability benefits, your SAGA payments stop coming. In fact, if either program approves you, the SSA will repay any SAGA benefits you received already. They’ll deduct the SAGA benefit amount you owe from your back benefits before depositing it directly into your account.

How to Apply for Social Security Disability Benefits in CT

You have 3 ways to start the application process for federal benefits:

- Apply online at SSA.gov (SSDI claims only). Unfortunately, you cannot apply online for SSI benefits anywhere.

- Have a Social Security attorney file your application free of charge to speed up the process. This is the only method that makes you more likely to receive benefits within 6 months.

- Make an appointment at a nearby Social Security field office. You cannot walk in and expect to fill out an application, unfortunately. New Trump Administration rules require everyone to call first and make an appointment ahead of time. Current SSA office wait times average around 35 days after you call to make your appointment. Plan to spend 4-5 hours there filling out paperwork.

How to Get Free Claim Help That Triples Your Chances for a Successful Claim Faster

Having a lawyer file your SSDI benefits claim nearly triples your chances for success on your very first try. Want to know if you may qualify for disability in Connecticut before you start the application process? Or help appealing a previous claim denial?

Click the button below to request your free, no-obligation consultation with a disability lawyer in your area now:

Get Your Free Benefits Evaluation

Lori Polemenakos is Director of Consumer Content and SEO strategist for LeadingResponse, a legal marketing company. An award-winning journalist, writer and editor based in Dallas, Texas, she's produced articles for major brands such as Match.com, Yahoo!, MSN, AOL, Xfinity, Mail.com, and edited several published books. Since 2016, she's published hundreds of articles about Social Security disability, workers' compensation, veterans' benefits, personal injury, mass tort, auto accident claims, bankruptcy, employment law and other related legal issues.