Important: We updated this article in August 2024 using the latest Social Security Administration policy and data available. Osteoarthritis is an incredibly common source of joint pain as we all grow older. You can develop it suddenly after a traumatic injury (like a car accident), or gradually, with age. Weight gain (such as with pregnancy) can also contribute to developing this type of arthritis. But is osteoarthritis a disability in the Social Security Administration’s eyes? Yes – keep reading to learn about osteoarthritis and disability benefits, including how to qualify, apply, and pay amounts.

Social Security Disability Benefits for Osteoarthritis: Key Takeaways

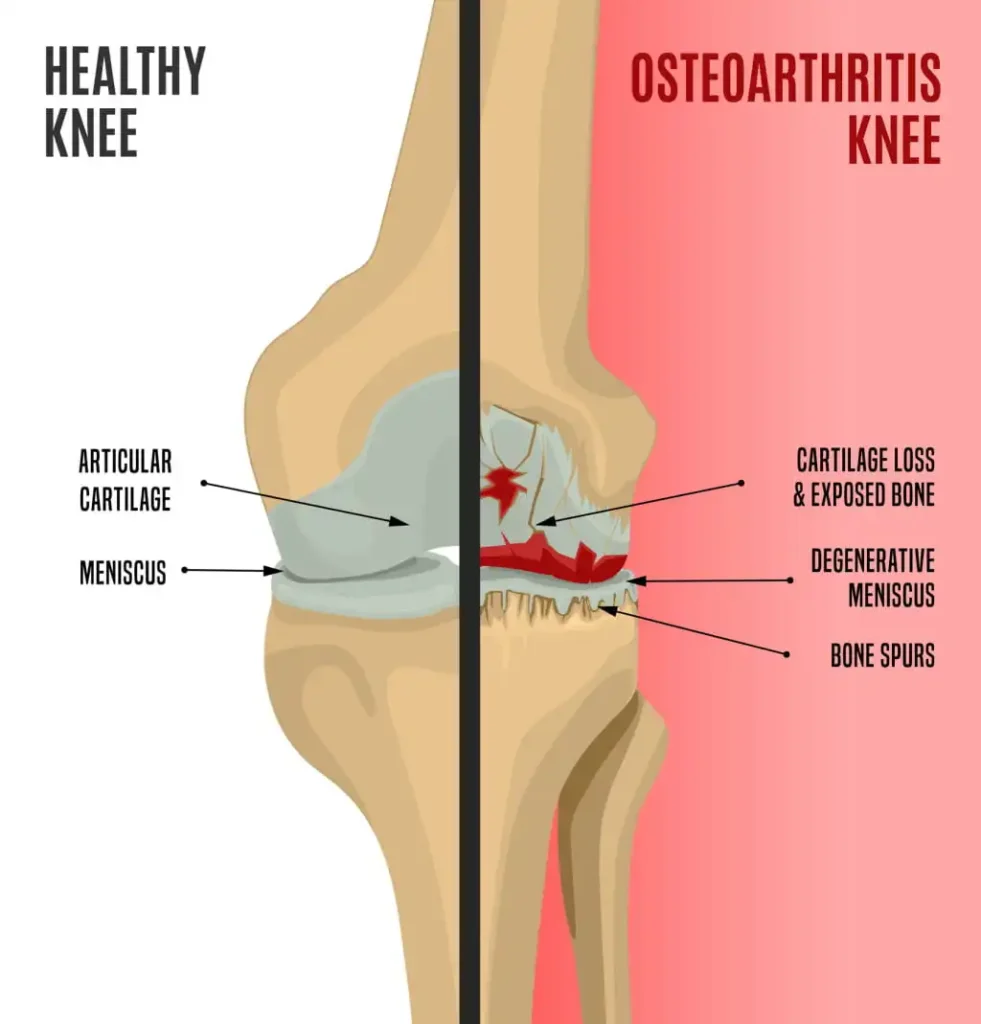

- Osteoarthritis – the most common form of arthritis – occurs when the cartilage around your bones shrinks.

- This loss of cartilage around the bones can lead to swelling, burning sensations, muscle weakness, and joint pain. If it advances, it can result in a loss of motion or an inability to do things you could do before.

- Osteoarthritis disability benefits are possible if the condition prevents your ability to work.

- Qualifying for disability for osteoarthritis can be challenging, particularly because it’s not listed in the Social Security Administration’s Blue Book.

- Even so, disability benefits for osteoarthritis are available if you can meet all requirements and file the proper paperwork.

- The average Social Security disability insurance (SSDI) payment in 2024 is $1,537 per month.

Is Osteoarthritis a Disability Under Social Security? Understanding Osteoarthritis and Its Impact

Osteoarthritis is only one kind of arthritis that causes chronic joint pain. There are several others, including:

- Rheumatoid arthritis

- Gout

- Whipple’s disease

- Ankylosing spondylitis

- Behcet’s disease

- Fibromyalgia

Osteoarthritis is a degenerative joint disease that affects various joints throughout the body. As cartilage wears down, it exposes the affected joint. That exposure can lead to mild symptoms, such as swelling or burning. But it can also lead to more serious symptoms, including:

- Limited range of motion

- Chronic pain when you move

- Inability to move without assistance

When the symptoms of osteoarthritis become so severe they impede your ability to work, you may qualify for disability benefits. Statistics show that currently, 15% of all adults 30 years or older have some form of degenerative joint disease. Experts estimate that by 2050, more than 1 billion people will have some degree of joint dysfunction because of it.

This number is attributed to our aging population, population growth, and obesity. Other causes include injury and a genetic predisposition to degenerative joint disease.

More women than men have it: In 2020, 61% of osteoarthritis cases were women while 39% were men.

Osteoarthritis is most common in the knees and hips. Projections show that cases that affect the following major joints will likely only increase in the future:

- Knees: +75%

- Hands: +48.6%

- Hips: +78.6%

- Other areas, such as the elbow or shoulder, are likely to increase by 95.1%

There is no cure for osteoarthritis, but you can treat it by reducing the stress on the affected joint. This can happen via changing behaviors, losing weight, and avoiding activities that trigger pain. Over-the-counter medications can effectively treat some symptoms, along with applying cold and heat to the affected joints.

Physical therapy can sometimes help ease symptoms, as can exercise. Doctors usually recommend low-stress exercise, like swimming and walking.

How Osteoarthritis Affects Daily Life and Ability to Work

Osteoarthritis can start as a more mild case of arthritis and present with symptoms like aches and pains, swelling, and burning.

If it’s more of a nuisance but you can still work, then the Social Security Administration will deny you disability benefits for osteoarthritis.

As the disease progresses, it may impede your ability to work due to pain, loss of motion, or not being able to move as you once did.

If interventions like losing weight, exercise, and alternating heat and cold don’t help, doctors can typically recommend more invasive treatments. This can include things like joint replacement surgery or reconstructive surgery.

Qualifying to Get Social Security Disability Benefits for Osteoarthritis

To qualify for Social Security disability benefits for osteoarthritis, you will need to complete the application and show four basic things:

- You’re unable to engage in substantial gainful activity (SGA) for at least 12 months, specifically because of the functional limitations the disease causes in your joints. This just means you have to prove you cannot work at all because of your osteoarthritis diagnosis.

- Your current income is less than $1,550 per month, or $2,590 if you’re blind. For SSI benefits, you’ll need to show limited income and that you own less than $2,000 in total resources. Couples need to own less than $3,000 between the two of them to qualify for SSI benefits.

- You do not currently receive any other Social Security benefits, including early or regular retirement.

- For SSDI benefits, you’ll also need to show you have enough recent work history to qualify. For anyone who applies after age 30, you’ll need 40 Social Security work credits to be eligible. Not sure how many you have now? If you worked 5 in the last 10 years while paying Social Security taxes, then you automatically meet this requirement.

Osteoarthritis itself isn’t listed in the Social Security Administration Blue Book. But it does appear in these related sections:

- 1.15: Disorders of the skeletal spine resulting in compromise of a nerve root(s)

- 1.16: Lumbar spinal stenosis resulting in compromise of the cauda equina

- 1.18: Abnormality of a major joint(s) in any extremity

What does this mean? If you can show your musculoskeletal functioning issues are equally severe as the limitations shown in one of these three sections, then you’re much more likely to get Social Security disability benefits for osteoarthritis.

Medical Records & Evidence You’ll Need to Support Your Claim

When the Social Security Administration evaluates your claim, they will look at your doctors’ notes, diagnostic tests, and treatment history. They may require that you meet with a doctor they employ for a consultative exam. This doctor will not only perform a physical examination to confirm your limitations, but also observe your demeanor and behavior.

Some simple measures they’ll observe might be:

- Can you walk into the exam office on your own without using any assistive devices (i.e., a cane or walker)?

- Can you get on and off the exam table on your own, or do you need help?

- Can you bend over and pick up something from the floor?

- Can you walk up and down steps without any help?

The agency evaluates each person’s residual functional capacity (RFC) based on the criteria listed in the relevant section of its Blue Book. This means that if your conditions matches what’s listed is under Section 1.18, they will likely look for physical indications of abnormal motion. But if your claim hinges on section 1.15, they won’t look at your arms, legs, or hands. Instead, they’ll evaluate how the disease affects your lumbar spine.

How Much Does Social Security Disability Insurance (SSDI) Pay for Osteoarthritis?

Every year, Congress reviews federal benefits and decides whether or not to apply a Cost-of-Living-Adjustment (COLA). If approved in October, then Social Security disability benefits can increase the following January to account for inflation. The maximum monthly Social Security Disability Insurance payment in 2024 is $3,822. The average payment, however, is much less: $1,537.

Important: The average SSDI benefits amount is a few hundred dollars lower than most disabled workers receive today. This is because the national average includes reduced payments made to children and other dependents.

Once you get SSDI payments for 24 months, you become eligible for Medicare insurance coverage.

Other Disability Benefits Options: Supplemental Security Income (SSI)

If you don’t have enough work credits for SSDI, then you might qualify for Supplemental Security Income (SSI). Instead of looking at your work history, you must be blind, disabled, or at least 65 years old and have very limited income. The Social Security Administration will also evaluate your medical evidence to determine eligibility if you’re younger than 65.

Single people who apply for SSI are eligible for no more than $943 each month. Couples who qualify together may receive up to $1415 in SSI payments every month.

In addition to cash benefits, SSI approval includes Medicaid coverage that starts the same month you get your first payment.

How to Apply for Social Security Disability Benefits

You have four ways to apply for disability benefits from the Social Security Administration:

- Online via SSA.gov.

- In person at your local Social Security office.

- Over the phone by calling 1-800-772-1213 Monday through Friday, 8am-7pm EST.

- For free through a nearby disability lawyer, which dramatically raises your odds of approval the first time you file.

A good lawyer help ensure you file the right medical documentation and fill out all required paperwork correctly. Attorneys also understand what related symptoms from other medical conditions can help strengthen your case.

If you prefer to try filing alone and without help from an attorney, you’re of course welcome to do so. However, you’ll likely wait anywhere from 18 months to 2.5 years for your first disability payment after going through multiple appeals.

Consult a Disability Attorney for Free to See if You May Qualify Before You File

Trying to prove osteoarthritis prevents your ability to work isn’t easy. However, experienced legal representation can triple your odds for a successful disability claim for severe joint pain. An attorney charges nothing up front to file your application. Plus, you’re more likely to get your first payment within 6 months of your filing date. The SSA takes 7 months to review claims filed without an attorney and deny 4 in 5 applications, on average. Most people can’t go for extended periods with no income, so working with an attorney can be extremely beneficial in such cases.

If an attorney fails to secure disability benefits for you, then you owe $0 in legal fees. But if you’re successful, you’ll only pay one small fee after the SSA awards you financial assistance. Want to speak with an advocate and learn whether you may qualify for disability benefits before you apply? We can provide you with a free, private case review and explain all of your options.

Click the button below to start your free online benefits quiz now to see if you may qualify for assistance:

Get Your Free Benefits Evaluation

Lisa Allen is a writer and editor who lives in suburban Kansas City. She holds MFAs in Creative Nonfiction and Poetry, both from the Solstice Low-Residency Program in Creative Writing at Pine Manor College. Prior to becoming a writer, Lisa worked as a paralegal, where she specialized in real estate in and around Chicago.